Understanding How PDF Fraud Works and Common Red Flags

PDF-based scams rely on the trust most people place in digital documents. Criminals exploit editable formats, metadata manipulation, and visual mimicry to create convincing forgeries. A forged file can be a renamed image, a doctored PDF, or a composite assembled from legitimate documents to form a fraudulent whole. Recognizing the difference between a genuine file and a manipulated one starts with awareness of the typical tactics: modified dates, inconsistent fonts, altered logos, and embedded images that don’t match the document's text or quality.

Look for discrepancies in metadata such as creation and modification timestamps that don’t align with the expected timeline. Metadata can be tampered with, but obvious anomalies like a recent creation date on what should be an archived invoice are immediate red flags. Visual inconsistencies are equally telling: mismatched font families, uneven line spacing, or logos that have been pasted as low-resolution images often signal an attempt to patch a document together. Invoices and receipts frequently reveal fraud through arithmetic errors, incorrect tax calculations, or missing reference numbers that would normally be present in authentic accounting records.

Pay attention to the document structure as well. Original PDFs exported from accounting systems typically include standardized headers, footers, and digital signatures or certificate chains. The absence of a verifiable digital signature or a cryptographic certificate can indicate a file that has been altered. Even when a signature appears present, validate the certificate chain and issuer. Simple checks—such as opening the file in a PDF viewer that displays digital signature status or inspecting properties for suspicious fonts and embedded objects—can help detect pdf fraud before funds or sensitive data are exchanged.

Techniques and Tools to Detect Fake PDFs, Invoices, and Receipts

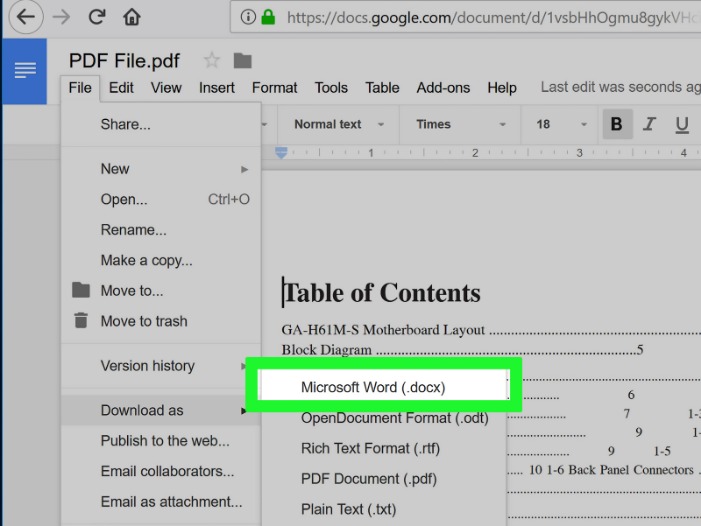

Detecting fraudulent PDFs requires a combination of manual inspection and automated tools. Start with basic viewer tools that reveal document properties and embedded objects. Examine the document’s history, metadata fields, and any attached files. Optical character recognition (OCR) can reveal when text has been embedded as an image rather than selectable text—an oft-used trick to avoid automated detection. Running OCR and comparing extracted text to the visible content can show discrepancies that point to manipulation.

Specialized software can analyze PDFs for signs of tampering: layers that don’t align, hidden form fields, and non-standard encodings. Companies and auditors often use forensic PDF analyzers to check signature validity, certificate authorities, and integrity hashes. Red flags include signatures that don’t validate, certificates issued by unknown authorities, or a mismatch between the signer’s identity and the document’s supposed origin. For accounts payable teams, cross-referencing invoice details with vendor records, purchase orders, and payment histories is critical. When in doubt, a verification workflow that includes supplier confirmation—by contacting a known vendor phone number or portal—reduces risk.

Automated services and platforms can expedite verification. For example, using a dedicated tool to detect fake invoice can surface anomalies faster than manual review. These tools typically scan for altered fields, inconsistent formatting, and signs of copy-paste edits, and some provide a confidence score or detailed report to guide further investigation. Combining these technical checks with human review enables a robust approach to detecting fraud in PDF documents before they cause financial or reputational damage.

Case Studies and Best Practices: Real-World Examples of Detection and Prevention

Real-world incidents illustrate how simple checks can prevent major losses. In one case, a mid-sized supplier submitted an invoice with slightly altered bank details to redirect payments. A vigilant accounts payable clerk noticed the font of the bank account line differed from the rest of the document and that the invoice number sequence didn’t match previous submissions. A quick verification call to the vendor uncovered the fraud before payment. That small attention to visual detail and a confirmation step saved the organization thousands.

Another example involved a fabricated receipt used to justify an expense reimbursement. The receipt’s date and vendor name were plausible, but the tax calculation didn’t match the listed subtotal and rate. Expense auditors using simple spreadsheet checks flagged the inconsistency and requested the original card transaction record. The mismatch exposed a pattern of falsified receipts by the claimant. These cases highlight that routine validation—matching totals, checking tax math, and confirming vendor identities—are powerful deterrents.

Best practices include instituting multi-step verification workflows, mandatory digital signatures with validated certificate authorities, and automated scanning of incoming documents for anomalies. Maintain an updated vendor master file with verified contact channels and require remittance information changes to be confirmed through known corporate contacts. Train staff to recognize fake receipts and fraudulent invoices and to escalate suspicious items. Regularly update detection tools and run random audits to catch novel manipulation techniques. By combining technological defenses with procedural safeguards, organizations can substantially reduce the likelihood of falling victim to PDF-based fraud.