As tax season approaches, many Americans find themselves navigating the complexities of tax documentation. One essential form that every employee should understand is the W2 form. This form is crucial for accurately filing your tax return and ensuring compliance with IRS regulations. In this article, we’ll provide a detailed look at W2 forms and their significance to both employees and employers.

What is a W2 Form?

A W2 form, officially known as the Wage and Tax Statement, is a document an employer must send to each employee and the Internal Revenue Service (IRS) at the end of the year. It contains vital information about an employee’s annual wages and the amount of taxes withheld from their paycheck.

Key Components of W2 Forms

The W2 form provides a wealth of information, including:

- Employee’s Social Security Number: Used to accurately associate the wages with the employee.

- Employer’s Identification Information: Includes the employer’s name, address, and Employer Identification Number (EIN).

- Total Wages, Tips, and Other Compensation: A summary of what the employee earned during the tax year.

- Total Tax Amount Withheld: Includes Social Security tax, Medicare tax, and federal income tax withheld.

- State and Local Tax Details: Information pertinent to state and local tax authorities.

Why W2 Forms Matter

The W2 form is a cornerstone document for several reasons:

- Tax Filing: Employees use it to file their personal income tax returns accurately.

- Social Security Credits: The form helps track earnings towards receiving future benefits.

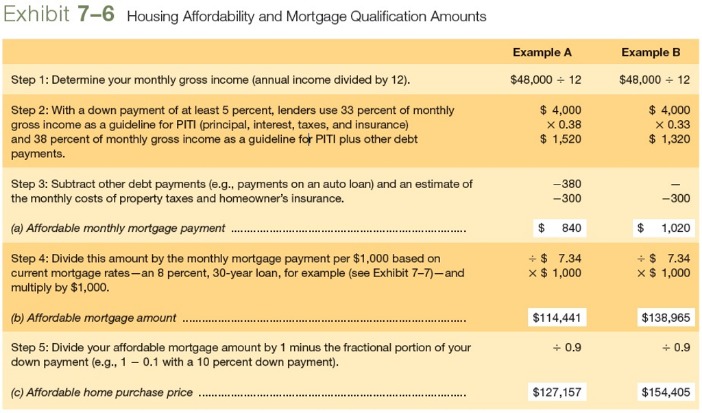

- Loan Applications: Lenders may require recent W2 forms as proof of income.

Frequently Asked Questions About W2 Forms

When should I receive my W2 form?

Your employer is required to send out W2 forms by January 31st. If you haven’t received it by early February, it’s a good idea to contact your employer.

What should I do if there’s an error on my W2 form?

If you notice any inaccuracies, inform your employer immediately to issue a corrected form, known as a W-2c.

How long should I keep my W2 forms?

The IRS recommends keeping copies of your W2 forms for at least three years, although many experts suggest holding onto them for up to seven years, especially if you’re involved in any tax disputes.

For more detailed guidance on W2 forms, visit W2 forms at American Tax Service, where you can find additional resources and expert advice on tax-related matters.

Understanding your W2 form is an integral part of managing your finances effectively and staying in good standing with tax authorities. Make sure to review your form each tax season to ensure that all personal information and income details are accurate.